The Spectacular Rise of the Indian Pharmaceutical Industry

Emerging economies typically get a boost when their homegrown industries partner with multinational giants on research and innovation. Such strategies have lifted the fortunes of China, Malaysia and Brazil in industries such as consumer electronics, automobiles and chemicals.

But the Indian pharmaceutical industry shows this isn’t the only path. Government policies and mistrust of foreign companies diverted India’s research capabilities away from innovation – until 20 years ago, when a key change in international business law and a change of heart among India’s lawmakers catapulted the Indian pharmaceutical industry into world markets.

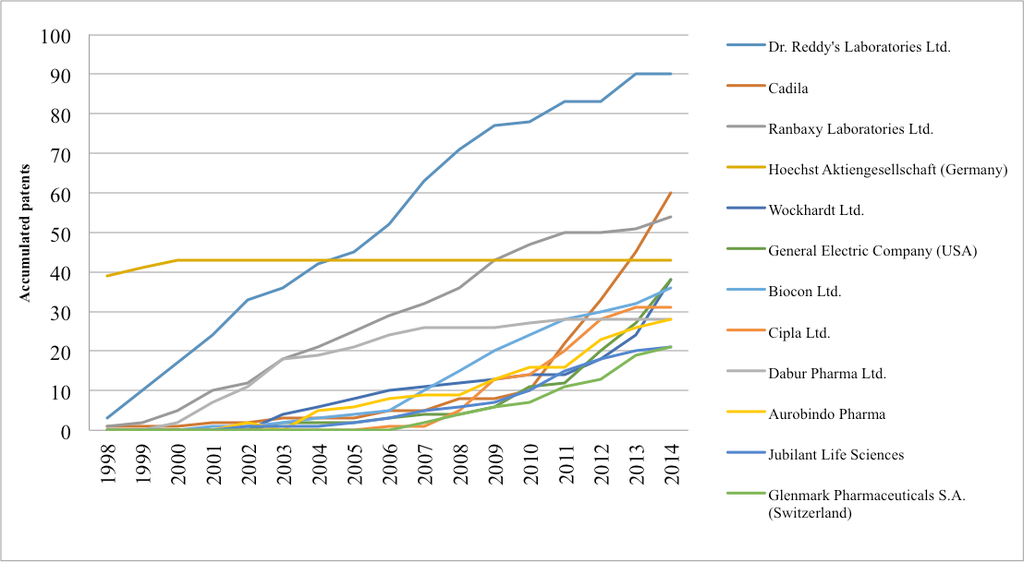

In an intriguing study, researchers Kristin Brandl (University of Reading, UK), Ram Mudambi (Temple University, USA) and Vittoria Giada Scalera (Politecnico di Milano, Italy) take a look at how this happened, and its spectacular results. Today fast-growing Indian pharmaceutical firms such as Dr. Reddy’s and Ranbaxy are developing and producing waves of innovative products for customers around the world.

“While most economies may benefit when local industries gain knowledge from multinationals, India’s example shows that there are alternatives -- but they all require strategic government investment,” said Mudambi, the Frank M. Speakman Professor of Strategy at Temple’s Fox School of Business, who led the study.

Before the early 1990s, the Indian pharmaceutical industry had no choice but to focus on knock-off drugs, since government policies discouraged imports. While India had no shortage of bright scientists graduating from its government-funded universities, most of them just worked on reverse-engineering established drugs to produce generic variants.

In the decades after independence in 1947, scientists at India’s government-run Council of Scientific and Industrial Research (CSIR) still created plenty of innovations. “They just never saw the light of day,” Mudambi says.

In 1995, India became part of the World Trade Organization (WTO) and ratified the Trade Related Aspects of Intellectual Property Rights (TRIPS), which set international standards for protecting trade secrets. At the same time, Mudambi explains, the CSIR began to realize that India’s pharmaceutical industry could no longer sit on the sidelines, and pushed for a bigger focus on innovation.

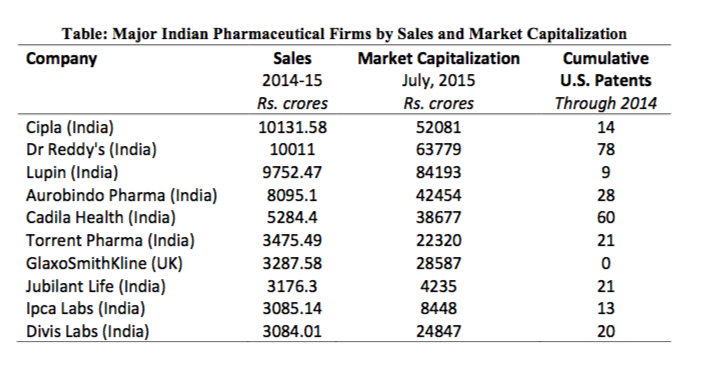

Since then, India’s homegrown talent has come into its own. The researchers saw the proof in the number of U.S. patents – the gold standard for measuring innovation. The CSIR led the way, obtaining 540 new U.S. patents in the past two decades were, versus just 27 from 1950 and 1993. The study demonstrates that Indian domestic pharmaceutical companies soon followed this government lead.

The conclusion: Not all innovation flows from bigger, more established companies. In India’s case, highly skilled human capital, governmental support and global linkages based on personal relationships helped the pharma industry grow rapidly after the barriers fell.

The Takeaway

One Size Doesn’t Fit All: Typically, small companies in emerging markets can learn from collaborating with multinationals, especially in R&D and innovation. But the Indian pharmaceutical industry shows that things can evolve differently, and raises some important questions for research, economic policy, and corporate strategy. Worth looking at: whether other science-intensive industries in other emerging markets will follow the same path, especially if government policy influences them more than competition.

Invest in research: “While other industries might get their spark from partnerships with big companies, government can be the catalyst in science industries,” Mudambi says. “It’s important for government to invest in the basic research that builds the foundation for local industries’ success in the future.”

Stock the Pipeline: To nurture innovation in research-intensive industries such as pharmaceuticals, governments in emerging countries must invest in the tertiary educational infrastructure that is the source of new scientists. “In a tech setting you might be able to get away with a bunch of kids, but you can’t be a serious player in pharmaceuticals without enough PhDs,” said Mudambi.