Opportunities Abound in Africa for Entrepreneurs and Investors

Meet Jean-Paul Nageri, the son to a banana farmer in Uganda. During the early-2020 harvest, JP's dad planned to use a middleman for distribution, but the deal fell through, leaving him with one acre of bananas to sell. Struggling to find a market, JP’s dad gathered family and friends to take the bananas to avoid spoilage.

What is clear here is that JP’s dad needed a solution. And JP, as a scientist, could make one.

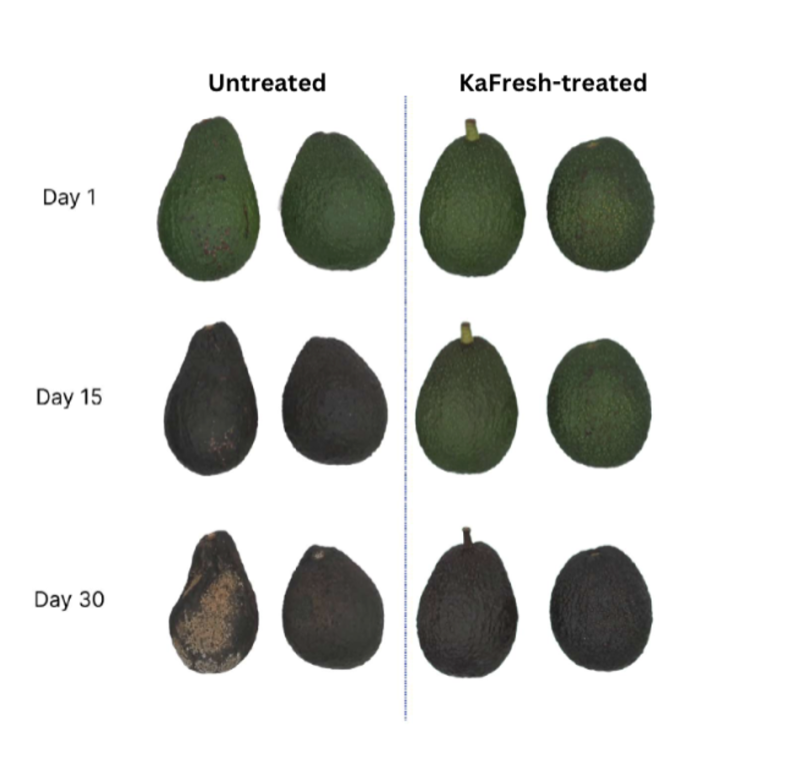

He developed KaFresh, an organic solution that increases the shelf life of all produce. To illustrate, KaFresh-coated avocados last 30 days and tomatoes last 40.

This is monumental, especially in markets like Uganda, where 40% of produce goes to waste. Unlike most preservatives and cold storage alternatives, KaFresh is unique in that it uses food to protect food by formulating plant-derived materials found in all fruits and vegetables we eat.

The impact on the African agricultural sector and global consumers will be huge:

- Impact on smallholder farmers: food security and increased revenue due to less spoilage

- Impact on exporters: higher revenues due to increased export volumes

- Impact to end consumers: fresher food that doesn’t spoil as quickly

This is an example of a pre-seed biotech company that we believe will one day not only transform Africa but also the entire world. And it’s also an example of how ripe the continent is for innovative products and services. In this article, we will provide an overview of Africa and its challenges and opportunities for entrepreneurs and investors from around the world.

As native Ugandans who live in the UK and US, our work has explored Africa’s history of tech and private investment to help people understand the present and predict the future. Much of what we learn is published on our blog, Sati, which stands for “Sourcing Africa to Invest.” We’ll come back to that later.

Africa: An Overview

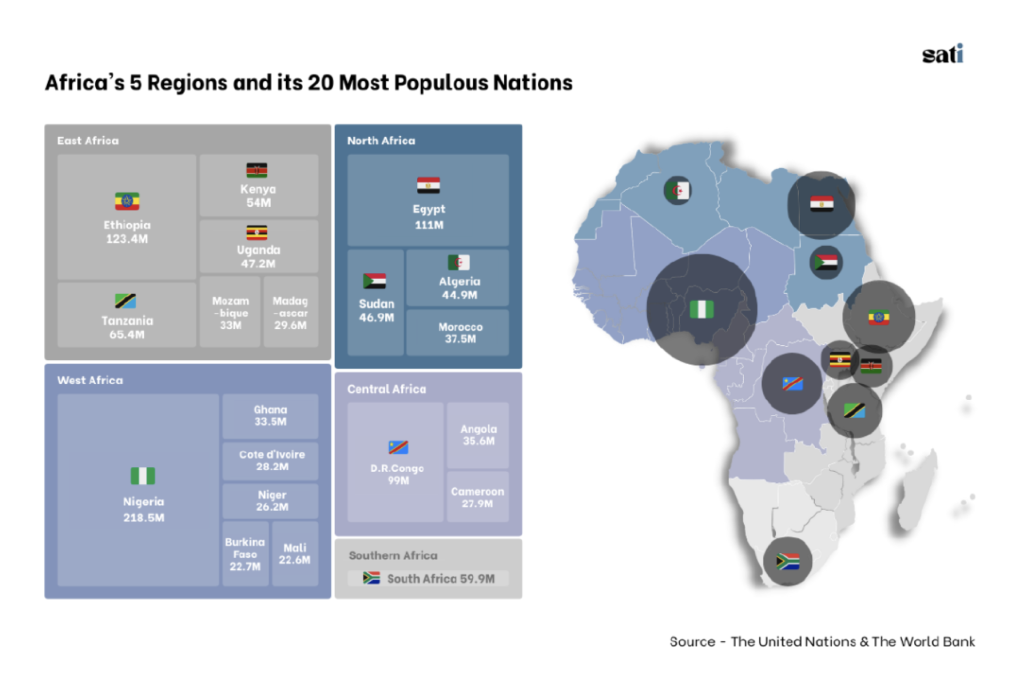

Africa is the second largest continent after Asia, covering an area more than triple that of the US. But there isn’t “one Africa.” The continent is uniquely diverse, with several cultures and states of development. According to the UN, the continent includes five regions with 54 countries. Africa is also the second most populous continent after Asia, with 1.4 billion inhabitants. This means Africans make up 20% of the world's 8 billion people. But currently, Africa’s nominal GDP is $3 trillion, which is just 3% of the globe's total of $100 trillion. Nevertheless, Africa’s GDP grew by 3.8% in 2022, and it’s expected to be the fastest-growing economy from 2025 onward.

Although Africa has a diverse set of 54 countries, 80% of the population lives in 20 countries. Africa’s “Big 4” countries alone -- Nigeria, Kenya, Egypt, and South Africa -- make up half the continent’s nominal GDP. This concentration plays into why those countries receive significant venture financing.

Notably, the world’s youngest population lives in Africa. Around 40% of people are under 14, and 60% are expected to be under 24 by 2025. As these figures suggest, Africa’s population is growing rapidly. By 2050, the population will nearly double to 2.5 billion and will be home to one third of the world’s young people (aged 15 to 35).

Taken together, the growing populations and economies of Africa make it of increasing interest to entrepreneurs and investors.

In the next section we’ll discuss some of the specific categories of business opportunities that Africa presents.

The types of startups that have typically succeeded in Africa vary across industries or sectors.

Fintechs

Fintech has proven to be a great investment opportunity for VCs, especially those that invested early. Several of Africa’s unicorns are fintech players. Here is why.

In 2021, 55% of Sub-Saharan Africans were banked, a significant improvement from 23% in 2011. Countries have leveraged different approaches to expand access to financial services, led either by banks or by telecoms. The markets dominated by mobile money -- like Kenya, Uganda, and Tanzania – don’t have a strong traditional banking infrastructure (e.g. bank branches and ATM machines).

Although there’s been progress, a large opportunity remains to encourage more people to leverage financial services, like digital payments. The fact that most transactions are still carried out in cash confirms this. Tech companies are using different approaches to push payments online. Some are building infrastructure for banking or mobile money; others are building e-wallets, virtual cards, digital savings, lending, wealth management, foreign exchange products, etc., to service consumers and businesses.

While business-to-business (B2B) models work across markets, consumer-focused fintechs do well in markets with large unbanked populations. They also tend to do well because their underlying value proposition doesn’t require consumers to tap into their disposable income. Instead, they provide access to financial services and drive revenue through transactions.

Logistics

Logistics startups use technology to make the movement of goods more efficient. We have written extensively about logistics and its opportunities across the continent. We did a deep dive into a company called Kobo360, “the Uber for trucks,” which disrupted the freight brokerage industry in Africa. In general, B2B ventures perform better when they focus on clients with deep pockets. Low-margin logistics focused on servicing smaller firms and individuals needs enough volume to drive venture scale returns.

Energy & Water

Africa has the lowest rates of electricity access in the world. However, access has improved from 25% in 2000 to 50% in 2021. Of Africa’s 54 countries, six provide citizens with full access to electricity, most of them in North Africa. Access to electricity is key to bolstering economic activity. And investing in this sector has been a major priority for the Kenyan market. Improving access requires making utilities financially viable. However, many power providers are cash-strapped. Therefore, they can’t deliver reliable and affordable electricity to their customers, let alone deliver electricity to those who currently must rely on inadequate alternatives.

Improving the performance of national utilities requires lowering the costs of supply. Given that national utilities are low on funding, this is where startups come in. For example, Sun King is the most highly funded Kenyan-based energy startup and it has raised over $625 million over the past 3 years. The company designs, distributes, installs, and finances solar energy solutions for the 1.8 billion global consumers who cannot reliably access or afford traditional electrical grid connections. Continued investment in this sector in the markets that need it most remains an opportunity.

Retail

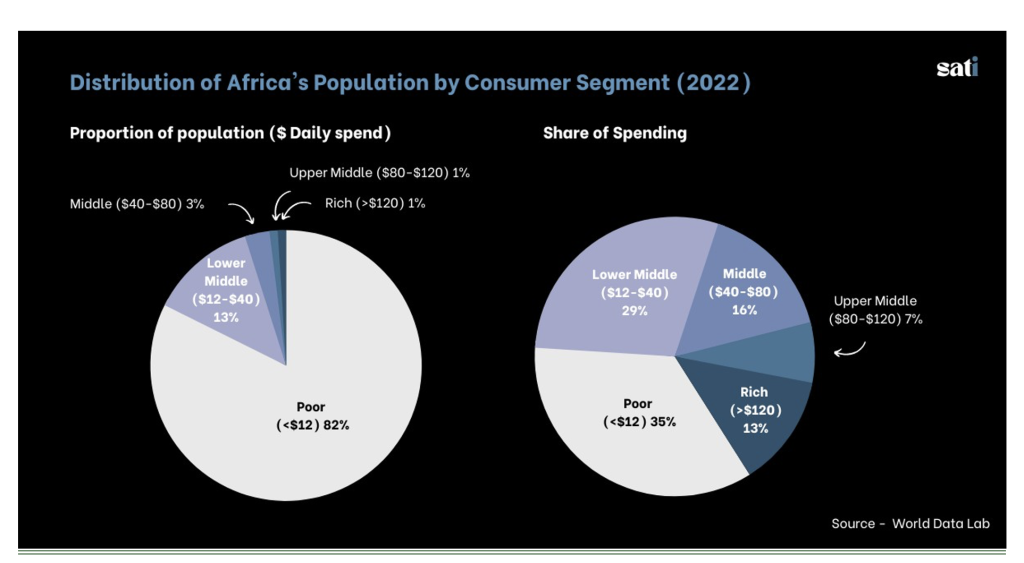

Africa has some of the lowest wages and consumer spend in the world. About 86% of people spend less than $12 per day. This segment of people contributes to 35% of the continent's consumer spend.

Urbanization will catalyze increased incomes and consumer spend. In the 1960s, 82% of Africa’s population lived in rural areas. Today, that figure has decreased to 56%. And by 2025, 45% of all Africans will live in a city. To date, several countries have cities with over 1 million inhabitants. That’s projected to grow to 71 cities in 2025 and 97 by 2035.

In metropolitan areas, consumer goods and services spending is typically 79% higher than the national average. Moreover, Africans who relocate to cities are closer to innovative technologies and growth, given the higher level of connectivity. This broadens employment opportunities and creates larger markets for commerce, which in turn drives greater consumer spending both on a personal scale and in the business sector.

By 2025, 65% of African households will be in the “discretionary spending” income bracket (earning more than $5,000 annually). Consequently, the profile of goods and services that Africans will purchase will shift from basic necessities to more discretionary products. These changes are likely to lead to greater entrepreneurial opportunities.

Consumer-facing retail sees success in markets with more disposable income. For example, Yuppiechef, a South African “omnichannel” retail business focused on kitchenware, was acquired by a retail group, Mr. Price, for $31 million in 2021. Hozmart, an Egyptian online retail business focused on home goods, has raised $40 million over the past 3 years with their latest round being a $23 million pre-series B.

B2B, or ‘Business-to-Business’

Using Gross National Income per capita as a proxy for individual income, Sub-Saharan Africans spend about 85% of their income, leaving just $200 annually in disposable income, compared to the average American’s $10,000. As a result of these factors, business models that depend on selling to consumers (i.e., “business to consumer,” or “B2C”) tend to struggle. Instead, sector-agnostic B2B and consumer fintech models have seen more success. This is true because businesses have more spending power.

Other sectors

Although Africa has the lowest internet usage in the world, access has risen from 2% in 2005 to 40% in 2022. And penetration is highest in North African markets. About 60% of African users have internet access through their smartphones. Mobile penetration has grown significantly, from 15 million mobile subscriptions in 2000 to 1.2 billion in 2021. Remember, Africa’s population is 1.4 billion, meaning that in several markets, individuals have more than one mobile phone subscription. Because mobile penetration is growing, more businesses are adopting digital to access customers. By 2025, Africa’s internet economy has the potential to reach 5.2% of GDP, contributing almost $180 billion to the economy. This potential depends on the right mix of policy actions and how efficiently businesses leverage digital technologies.

For several reasons, startups in sectors like HealthTech and InsureTech have traditionally received less funding. However, these sectors deserve consideration as investment opportunities because they serve large and often untapped markets. Therefore, venture scale returns are achievable by leveraging the appropriate distribution strategy, particularly a B2B approach.

Venture Capital in Africa

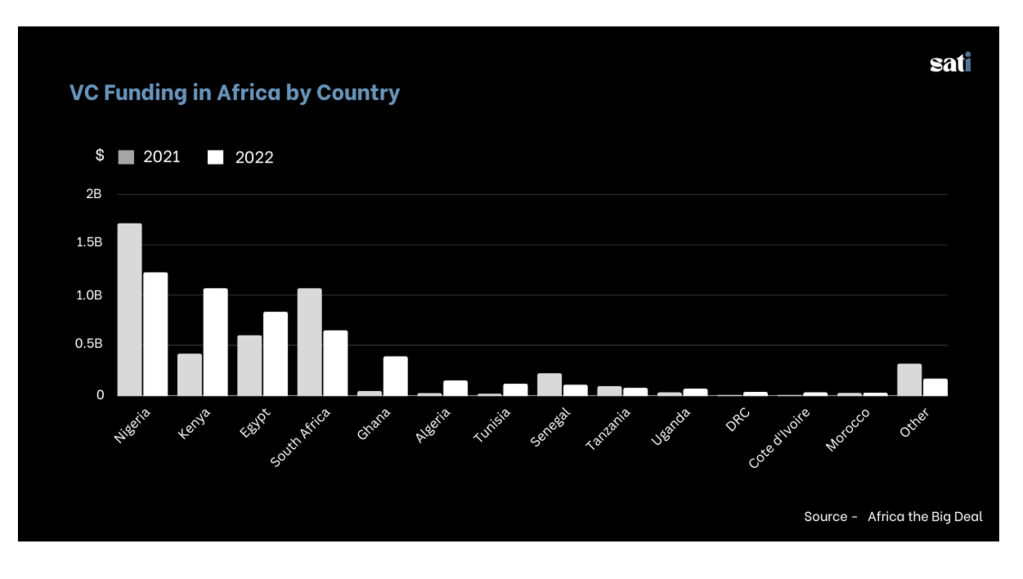

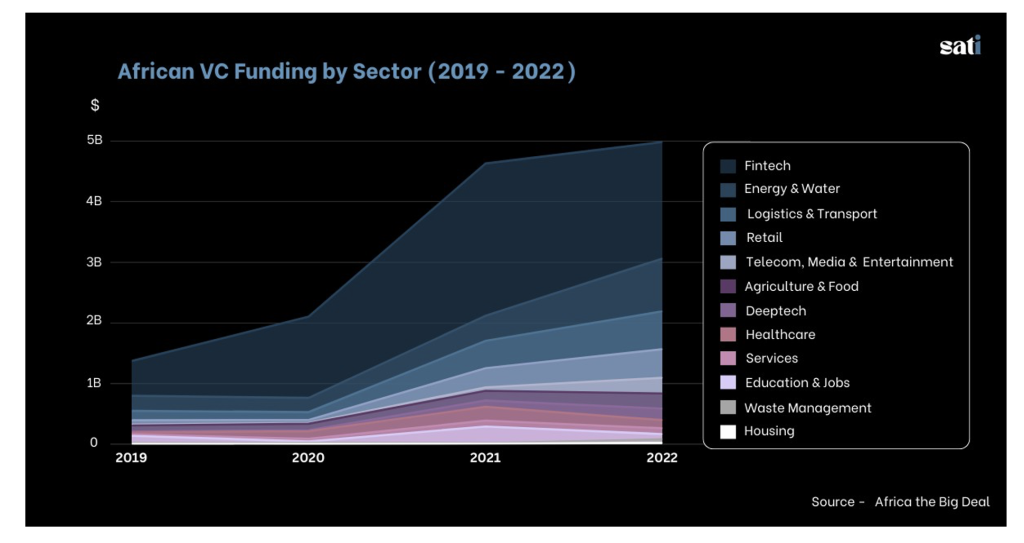

According to Briter Bridges, Africa received 1% of the world’s VC funding in 2022. However, there’s been significant year-over-year growth in funding, with a large increase in 2021.

African entrepreneurship has already produced seven “unicorns,” or companies valued at more than $1 billion. Six of these are in Fintech. For example, Interswitch is Africa’s oldest unicorn. It was founded in 2002 as a nationwide transaction switching platform. Flutterwave, founded in 2016, is a Nigerian API-driven platform that aggregates payment gateways across the continent, allowing merchants to accept card and alternative payments easily.

All major markets saw increased venture capital funding in 2022 except two of the Big 4: Nigeria and South Africa. Deal value in Nigeria decreased in 2022 because there were fewer mega deals, but deal count increased in all markets apart from South Africa.

Fintech has consistently received the most funding, however, saw a slight decrease in 2022 - again, due to fewer mega deals. Although funding decreased for fintech and a few other sectors, deal count increased for all excluding deep tech, meaning more smaller checks were written.

Women get a lower value of funding, on average, than men. We explore why here.

There are several differences between the VC/startup scene in Africa and North America.

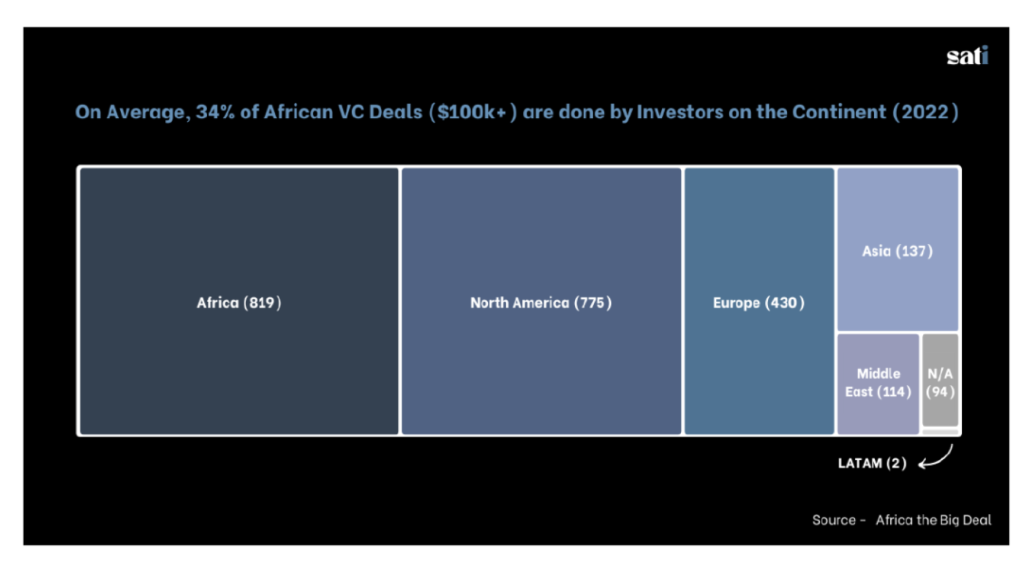

Most VCs on the continent are pre-seed and seed stage investors. Therefore, growth stage companies need to access capital from international investors to progress.

Each country has a distinct regulatory environment, infrastructure, and market dynamics. Therefore, the strategies needed to scale across African markets vary in comparison to North America’s more uniform landscape.

Given Africa’s lower cost of living, serving customers requires less funding. Therefore, startups in Africa can leverage modest injections of capital to jumpstart and progress operations. Moreover, startup valuations are lower but North American expectations for exit multiples can still be achieved.

Due to lower access to capital, startups in Africa prioritize profitability from Day 1. The growth-at-all-costs model often played out in North America takes a back seat as companies focus on self-sustainability.

Finally, there aren’t many startups based in Africa on the NYSE. The primary exit path for investors has been through mergers and acquisitions or secondary sales.

Despite these differences, two things remain the same. Successful startups are built by founders uniquely positioned to solve a large market opportunity. And given that Africa is the last frontier, plenty of opportunities exist for both founders to build and investors to invest.

Learn More

As you can see, there is a great deal of opportunity in Africa for both entrepreneurs and investors.

If you enjoyed this overview and want to dig deeper into specific topics, here are areas we have explored on our blog, Sati:

- Gender diversity of equity investing in Africa

- The genesis and evolution of mobile technology on the continent

- A deep dive into one of Africa’s most notable companies: MFS Africa

- Why transporting goods is 50% more expensive in Africa than in developed nations

- A deep dive into a company solving logistics challenges in Africa through freight forwarding: Kobo360.

Or, if there are other topics you’d like us to look into, you can reach us via email: [email protected].